At Aviva, we offer great value car insurance for women and men alike. You can choose between comprehensive cover or third party, fire and theft. We reward safe drivers regardless of their gender, which means we can provide affordable cover for you, your car and your possessions. Click here to get a car quote.

Car insurance for women as part of Aviva's car insurance product offering.

Breakdown rescue cover

If you ever find yourself in need of assistance during a breakdown, we have you covered 24 hours a day, seven days a week.

Driving other cars

You, as policyholder, can get third party cover to drive other people’s cars if you have a full, current EU or UK driving licence. Some restrictions apply.

No-claims discount

Up to 50% off the price of your car insurance when you have 5 years claims free driving in your own name.Footnote [2]

Get a car insurance quote

Take out your car insurance policy online and we'll give you a 15% discount.Footnote [1]

Car insurance discounts

Who doesn’t want to save money on their car insurance? At Aviva, we offer valuable car insurance discounts for women and men alike. These discounts range from 10% up to 50% off your premium:Footnote [1]

Loyalty discount

Insure your car and home with Aviva and get 15% off both policies.

No penalty points

If you don’t have any penalty points when renewing your insurance, you can get a discount of up to 19% off your premium.Footnote [1]

Multicar discount

10% off the cost of a second car in your household with Aviva Multicar discount.Footnote [3]

Choose your car insurance cover

- We offer you a choice between comprehensive or third party, fire and theft cover.

- Both covers give you excellent benefits.

- You can customise them with optional covers or extras so they're just right for you. We also offer great discounts to keep your costs down.

Car insurance benefits

We’ve a wide range of benefits available for you including:

Windscreen damage cover

If that dreaded crack appears on your windscreen, your comprehensive car insurance will cover the damage if you use one of our aligned windscreen repairers.

Courtesy Car

While your car is being repaired by an Aviva Motor Services repairer, we’ll provide you with a courtesy car for up to seven days if you make a claim under your policy.

24/7 Claims Helpline

You can contact us 24 hours a day, 365 days a year on 1800 147 147 for help on all motor claims including windscreen damage claims.

Online Servicing

Avoid the €25 administration fee applied through our call centre by making changes to your policy free of charge through our online self-service facility, MyAviva.

Terms and conditions apply. Please see our policy documents for more information.

Car Insurance Policy details

Important information about your car insurance. You may find our glossary of terms helpful when reviewing your car insurance documents. Our assumptions are also available.

Looking for more information?

Loyalty Offer

Insure your car and home with Aviva and get 15% off both policies.

Optional cover

One size doesn't fit all so you can tailor your car insurance cover to meet your needs.

MyAviva Car

A self-service portal so that you can manage, review and make changes to your car insurance policy online.

Car articles

Take a look at our library of helpful articles and latest car insurance news.

Expert car maintenance tips with Mark Noble

Keep your car running smoothly with expert tips from Mark Noble. In this easy-to-follow video series, learn essential maintenance skills

Digital Detox Breaks in Ireland

Experience nature, mindfulness, and relaxation without the distractions of technology. These serene locations in Ireland offer the perfect backdrop to disconnect.

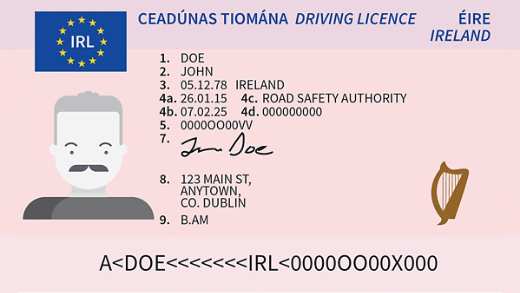

New driver number rules

From 31st March 2025, drivers in Ireland will need to provide their driver number when buying or renewing car insurance.

Penalty Points in Ireland and car insurance

Did you know you can reduce your car insurance premium by being penalty points free? Safe driving is key. Guide on penalty points and car insurance.

How Much Does It Cost to Charge an Electric Car in Ireland?

Our guide explains the difference in costs between charging at home and a public chargepoint, and the grants that come with choosing to buy an electric car.

Car seats – Safe driving with children

From newborn car seats to booster seats, this guide will take you through the best features for each age group to keep children safe while driving.

10 Common Reasons Cars Break Down

Let’s explore some of the most common reasons cars can break down and how to avoid them, ensuring you stay safe and secure on the road.

What to Do if You Have a Used Car Problem

Buying a new vehicle can be exciting, but excitement can turn to panic if you find a problem with a second-hand car.

NCT vs MOT: The Differences for Irish and UK Drivers

There are key differences between the NCT and MOT systems that drivers should be aware of, especially if you are looking to buy an import from the UK.

Here's What You Need to Know to Import a Car to Ireland

We’ll cover considerations for importing a car to Ireland, including how to insure your imported car, stay within budget, and key details to keep in mind.

Nine step ultimate checklist before driving

Maintaining your vehicle is crucial - to help drivers as they prepare to travel, we’ve put together a 9 -step ‘ultimate’ checklist.

A very special Christmas surprise!

Witness pure excitement unfold as what appears to be a routine car fix turns into an unforgettable surprise for 12-year-old Taylor Swift superfan, Eleanor.

Higher or Lower with Irish Rugby players

We put a few Irish Rugby Players through their paces with a game of Higher or Lower! Jimmy O’Brien, Jordan Larmour and Jack Conan were the brave contestants.

Holidaying at home: Your complete guide to green getaways – Part Two

In part two of our eco staycations guide, we look at three further Irish destinations to holiday with the environment in mind. So, you’ll be ready to staycation!

The Best Small Electric Cars in Ireland 2023

Are you looking to switch from a conventional vehicle to an electric car? Find out about the most popular small EVs that are on the market in 2023.

Lost Driving Licence? Here’s What You Need to Know

If you need a replacement driving licence but don’t know where to start, here’s all the information you need.