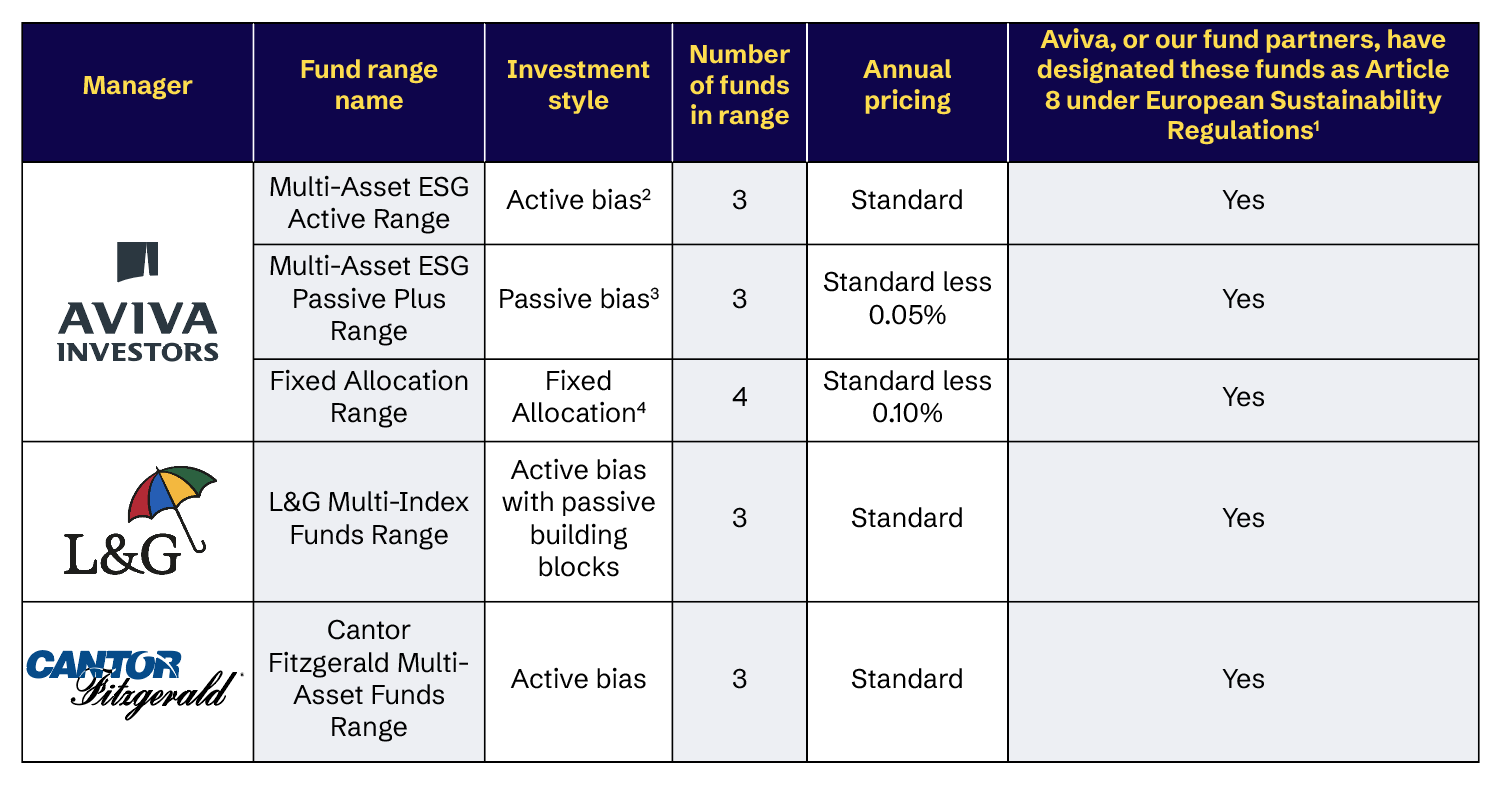

If you value simplicity when you invest, we offer a range of ready-made, multi-asset funds through our Managed for You range. This range includes options from different managers, risk profiles, and investment styles.

Understanding Multi-Asset Funds

Multi-Asset Funds invest across a number of different asset types which may include equities, bonds, property, cash, and alternatives. This gives you a greater degree of diversification than investing in a single asset class. Diversifying across a broad range of asset classes, styles, sectors, and regions can help cushion against any shocks that come with investing in a single asset class. However, investors should remember that diversification cannot fully protect them from market risk.

Understanding ESG

ESG investing considers a company’s Environmental, Social, and Governance practices, alongside more traditional financial measures. Funds classified as Article 8 Funds, do not have a specific sustainability objective.

More about the Aviva Multi-Asset ESG Range

We offer several types of Multi-Asset ESG Funds to meet the different needs and risk profiles of investors. You simply work with your Financial Broker to choose the fund that best matches your investment goals, your preferred investment style, and the level of risk you’re comfortable taking. Then our professional Aviva Managers will take care of the rest.

Aviva Multi-Asset ESG Active Range3

- Three funds, each aiming to grow your money, while managing to a level of risk that you’re comfortable with.

- Active bias, the fund manager makes active investment decisions on an ongoing basis.

- Each fund spreads your money across a diverse range of different investments, including equities, bonds, cash, and alternatives.

Aviva Multi-Asset ESG Passive Plus Range3

- Three funds, each aiming to grow your money, while managing to a level of risk that you’re comfortable with.

- Passive bias, each fund is managed to longer-term investment objectives with few short-term active investment decisions being made.

- Each fund spreads your money across a diverse range of different investments, including equities, bonds, cash, and alternatives.

Aviva ESG Fixed Allocation Range

- Four funds, aiming to deliver risk and return expectations in line with set allocations to Global Equities and Fixed Income.

- These funds are passively managed with passive building blocks.

- Each fund combines equities and bonds, with a fixed allocation to each asset class which is rebalanced monthly.

Aviva My Future ESG Lifestyle Strategies4

- A range of three lifestyle strategies tailored to your selected retirement age and chosen option at retirement Approved Retirement Fund, Annuity or Lump Sum.

- This strategy automatically transitions you to lower-risk investments as you get closer to retirement.

Key Documents

Customer Guides

Customer Reports

Gross Fund Factsheets

-

Multi-Asset ESG Active 3 Gross Fund Factsheet

PDF

-

Multi-Asset ESG Active 4 Gross Fund Factsheet

PDF

-

Multi-Asset ESG Active 5 Gross Fund Factsheet

PDF

-

Multi-Asset ESG Passive Plus 3 Gross Fund Factsheet

PDF

-

Multi-Asset ESG Passive Plus 4 Gross Fund Factsheet

PDF

-

Multi-Asset ESG Passive Plus 5 Gross Fund Factsheet

PDF

-

Fixed ESG 20 Gross Fund Factsheet

PDF

-

Fixed ESG 40 Gross Fund Factsheet

PDF

-

Fixed ESG 60 Gross Fund Factsheet

PDF

-

Fixed ESG 80 Gross Fund Factsheet

PDF

-

L&G Multi-Index III Gross Fund Factsheet

PDF

-

L&G Multi-Index IV Gross Fund Factsheet

PDF

-

L&G Multi-Index V Gross Fund Factsheet

PDF

-

Cantor Fitzgerald Multi-Asset 30 Gross Fund Factsheet

PDF

-

Cantor Fitzgerald Multi-Asset 50 Gross Fund Factsheet

PDF

-

Cantor Fitzgerald Multi-Asset 70 Gross Fund Factsheet

PDF

For performance of funds with different annual management charges please see our Fund Centre.

Video Library

Our 1-minute pitches

In this 1 minute videos, our investment experts give a quick snapshot of our Multi-Asset ESG Range

Aviva MultiAsset ESG Active Range

Transcript

00:00:00 Video Starts

00:00:05 - Question

Shane O'Brien One Minute Pitch.

Aviva's Multi-Asset ESG Active Fund Range,

Your time starts now. What are multi-asset ESG active funds?

00:00:16 - Shane

The clues in the name? They are multi-asset funds. They have ESG integrated, and they're managed with an active investment bias.

00:00:22 - Question

What do you mean by active investment bias?

00:00:24 - Shane

We mean two things. We mean that we actively select securities, but we also use active asset allocations. That's choosing between different asset classes like equities, bonds and alternatives.

00:00:33 - Question

Who manages these funds?

00:00:35 - Shane

They're managed by Aviva Investors. We are the investment part of the Aviva Group and we've been managing multi-asset funds for over 40 years.

00:00:41 - Question

How is ESG integrated into these funds?

00:00:43 - Shane

ESG is integrated in three ways. Number one, we actively select securities that have strong ESG credentials. Number two, we actively engage with the companies that we hold within the portfolio. And number three, there are certain sectors that we exclude like coal and tobacco.

00:00:58 - Question

What are the benefits of investing in these funds?

00:01:01 - Shane

The benefits are they are broad, diversified multi asset funds. ESG is integrated and we have a very long, strong track record dating back over ten years.

00:01:08 - Question

Does it cost any more to invest in these funds?

00:01:10 - Shane

It does not. They're available at standard fees.

00:01:12 - Question

Shane, your time is up.

For more information on Aviva Multi Asset ESG Active Fund range and how to invest, contact your financial broker.

00:01:35 Video Ends

Aviva Multi-Asset ESG Passive Plus Range

Transcript

00:00:00 Video Starts

00:00:05 - Question

Shane O'Brien One Minute Pitch

Aviva's Multi-Asset ESG Passive Plus Fund Range

Your time starts now. What are Multi-Asset Passive Plus Funds?

00:00:16 - Shane

They are diversified multi asset funds managed with a passive bias, so it's about setting up diversified portfolios, not changing them too regularly and letting the asset classes grow the investment over time.

00:00:27 - Question

What do you mean by passive plus?

00:00:29 - Shane

I mean that most of the strategies are passively managed within the fund. There are some components which are active in places like property and alternative investments.

00:00:36 - Question

Who manages these funds?

00:00:37 - Shane

They're managed by Aviva Investors. We are the investment part of the Aviva Group and we've been managing multi asset funds for over 40 years.

00:00:44 - Question

How is ESG integrated into these funds?

00:00:46 - Shane

In three ways. Firstly, we systematically tilt the portfolio towards better scoring ESG companies. Secondly, we engage with the companies we hold. And finally, there are certain sectors we don't invest in like coal and tobacco.

00:00:58 - Question

What are the benefits of investing in these funds?

00:01:00 - Shane

They are diversified, they are ESG tilted, and they are cost effective.

00:01:05 - Question

And how much does it cost to invest in these funds?

00:01:07 - Shane

They're available at .05% below standard charges.

00:01:11 - Question

Shane, your time is up.

For more information on Aviva's Multi Asset ESG Passive Plus Fund Range and how to invest, contact your financial broker.

00:01:35 Video Ends

Aviva Fixed Allocation Fund range

Transcript

00:00:00 Video Starts

00:00:04 - Question

Peter Smith One Minute Pitch.

Aviva's ESG Fixed Allocation Fund Range

Your time starts now. What are Aviva's ESG Fixed Allocation Funds?

00:00:14 - Peter

They are a range of four multi asset low-cost funds that invest in equities and bonds in fixed proportions.

00:00:20 - Question

What do you mean by fixed allocation?

00:00:22 - Peter

Each fund has a set weight to equities and bonds and is rebalanced on a quarterly basis, holding between 20 and 80% in equities.

00:00:29 - Question

Who manages these funds?

00:00:31 - Peter

Aviva Investors we're the asset management arm of the Aviva Group and have over 40 years’ experience managing multi asset portfolios.

00:00:38 - Question

How is ESG integrated into these funds?

00:00:40 - Peter

In three ways, we tilt more to the holdings that will have a higher ESG rating. We engage with the companies that we hold, and we also avoid certain industries and sectors.

00:00:51 - Question

What are the benefits of investing in these funds?

00:00:54 - Peter

The funds offer a low cost, straightforward way to invest in markets, in a transparent and provide transparent returns.

00:01:02 - Question

And finally, does it cost any more to invest in these funds?

00:01:05 - Peter

No. In fact, it costs .1% less than standard pricing.

00:01:09 - Question

Peter, your time is up.

For more information on Aviva's ESG Fixed Allocation Funds and how to invest, contact your financial broker.

00:01:32 Video Ends

Aviva My Future ESG Lifestyle Strategy

Transcript

00:00:00 Video Starts

00:00:05 - Question

Stephen Rice One Minute Pitch.

Aviva My Future ESG Lifestyle Strategies.

Your time starts now. What are the Aviva Lifestyle Strategies?

00:00:15 - Stephen

They are three pension savings strategies tailored to your selected retirement age and whether you're looking to fund for an approved retirement fund annuity or a lump sum at retirement.

00:00:25 - Question

How are my Pension savings managed?

00:00:27 - Stephen

Aviva will automatically deviate your pension from higher risk funds to lower risk funds as you near retirement, so you don't have to.

00:00:34 - Question

Where are my Pension savings invested?

00:00:36 - Stephen

Your money is invested in a combination of equities and bonds to Aviva's Fixed Allocation ESG Funds and in the last five years a cash allocation is introduced to meet your tax-free lump sum.

00:00:46 - Question

As these are ESG strategies. Will my savings be invested sustainably?

00:00:50 - Stephen

Yes. Our fixed allocation range is designated as Article 8 under the Sustainable Finance Disclosure Regulations.

00:00:56 - Question

What are the advantages of investing in this manner?

00:00:58 - Stephen

The My Future Strategies are cost effective investment strategies professionally managed by Aviva Investors.

00:01:04 - Question

And how much does My Future ESG cost?

00:01:06 - Stephen

They are available at a 0.1% discount to our standard management charges.

00:01:11 - Question

Stephen, your time is up.

For more information on Aviva's My Future ESG Lifestyle Strategies and how to invest, contact your financial broker.

00:01:34 Video Ends

Expert advice

Want expert advice on pensions and retirement? Contact your Financial Broker today.

Warnings

Important information to consider.

| Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: If you invest in these funds you may lose some or all of the money you invest. Warning: These funds may be affected by changes in currency exchange rates. |

|---|

1. The European Regulations are the Sustainable Finance Disclosure Regulation (Regulation (EU) 2019/2088) (SFDR). This regulation is designed to improve transparency in relation to sustainability risks and impacts in relation to financial products in the market and make it easier for investors to distinguish and compare the available sustainable investing strategies. Article 8 Funds consider ESG factors as part of their investment process, but they do not have a specific sustainability objective. Beyond any binding ESG constraints in the strategy and baseline exclusions policy, the investment manager retains discretion over final investment decisions, taking into account wider risk factors.

2. Active bias, the fund manager makes active investment decisions on an ongoing basis.

3. Passive bias, the fund is managed to longer-term investment objectives with few short-term active investment decisions being made

4. Fixed Allocation Funds combine equities and bonds, with a fixed allocation to each asset class which are rebalanced monthly.

Aviva Life & Pensions Ireland Designated Activity Company, a private company limited by shares. Registered in Ireland No. 165970. Registered office at Building 12, Cherrywood Business Park, Loughlinstown, Co. Dublin, D18 W2P5. Aviva Life & Pensions Ireland Designated Activity Company, trading as Aviva Life & Pensions Ireland and Friends First, is regulated by the Central Bank of Ireland. Tel (01) 898 7950 www.aviva.ie