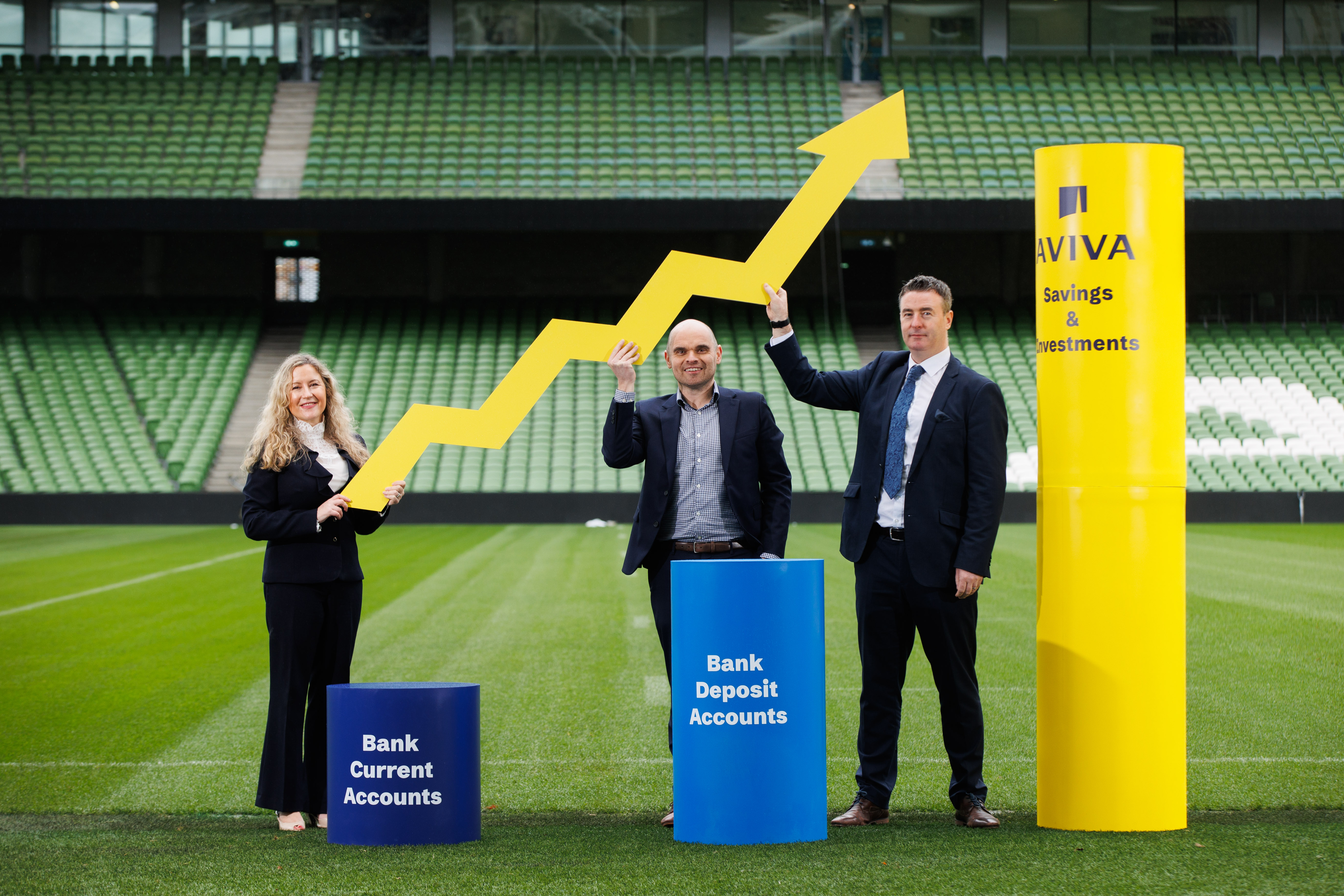

Saving vs Investing: The best teams have balance. So should your finances

David Byrne, Savings and Investments Proposition Lead, Aviva Life & Pensions Ireland DAC

When managing your money, consider it like building a winning football squad. You wouldn't send 11 strikers onto the pitch, right? Just like in football, your financial game plan needs balance — and that's where saving and investing come into play.

Whether saving for a rainy day in Kerry or investing for a dream retirement in the Algarve, understanding the difference between saving and investing is key to becoming a financial legend.

Saving: Your reliable goalkeeper

Saving is like your trusty goalkeeper — safe, steady, and always there when you need them. You save your money in a bank savings account, and it stays protected from market ups and downs. It's perfect for short-term goals like:

- Booking a last-minute trip

- Covering unexpected car repairs

- Building an emergency fund for life's curveballs

But here's the kicker — savings accounts often offer lower interest rates, and inflation can sneak past your defence, chipping away at your money's value over time.

Types of Savings Accounts:

- Easy Access: Like a sub off the bench — ready when needed.

- Notice Accounts: You'll need to give a heads-up before withdrawing.

- Fixed Rate Accounts: Lock it in for a set time and earn a fixed return.

Investing: Your star striker

Investing is your bold centre-forward, aiming for long-term goals and willing to take a few risks to score big. You put your money into things like company shares or funds and while the value can go up and down, the growth potential is much higher over time.

Investing is ideal for:

- Saving for your child's university fees

- Planning a mortgage-free retirement

- Growing wealth over 5+ years

Just like a striker might miss a few shots, investments can dip, but with time and strategy, they often come out on top.

Saving vs Investing: Which should you choose?

Think of your finances like a match strategy. You need both defence and attack:

| Feature | Saving | Investing |

|---|---|---|

| Risk | Low | Low to High depending on the funds you invest in |

| Returns | Low | Potentially High |

| Access | Easy | May be restricted |

| Best For | Short-term goals | Long-term growth 5 Years + |

The tax advantage

In Ireland, you can access tax-efficient investment and pension options. Make sure you're using them to your advantage — just like a manager uses every sub wisely.

Final whistle: Be the legend of your own financial pitch

Whether you're a cautious keeper or a daring striker, the key is to build a balanced financial team. Start with savings to cover your bases, then bring in investments to chase your long-term goals.

Get expert advice

And remember — even the best teams need a coach. If unsure, chat with a financial broker to help pick the right formation for your future.

This article is not intended to give advice or a personal recommendation. If you'd like a personalised recommendation based on your circumstances, you should speak with a financial broker. You can find a financial broker on brokersireland.ie.

Revenue rules and terms and conditions apply. Remember that tax laws can change over time, so it is important to check revenue.ie for the latest information.