Smaller incidents on our roads are a regular occurrence – but that doesn’t mean they’re not a big deal. In fact, for most drivers the thought of being involved in an accident of any size is amongst their worst fears, and knowing what to do in the immediate aftermath is important for anyone getting behind the wheel.

If you find yourself involved in a minor car accident, here’s a comprehensive guide to the steps you should take next.

Stop, and slow down

You are legally required to stop at the scene of the accident and take steps to proper care for yourself and others involved1 – so pull in as soon as it’s safe to do so. Once you have done this, take a few deep breaths and try to settle your nerves; no matter how small the accident, it’s still going to be a bit of a shock.

Apply your handbrake, turn on your hazard lights, and place your warning triangle behind your car to warn oncoming traffic that there has been an incident and your car is pulled in.

Check for injury

Check yourself and other passengers for injuries. If there’s another car involved, check that the people there are alright too. If anyone is in pain, bleeding or in need of assistance, call an ambulance.

Call the Gardaí

It’s important to make contact with the authorities in the event of an accident; even if they don’t attend, they’ll be the ones to create an official report. While the Gardaí may make a decision on whether or not to attend depending on the severity of the incident, it’s vital you request their presence if you believe the other driver is not in a fit state to drive, is unable to provide insurance or license details or if they leave the scene.

The Gardaí will also provide a recorded incident number as proof that the incident was reported.

Collect additional information

If there are no injuries, make a note of that just in case any discrepancies arise following the incident. There’s lots more information you should try to record which could become very important when making a claim to your insurance company.

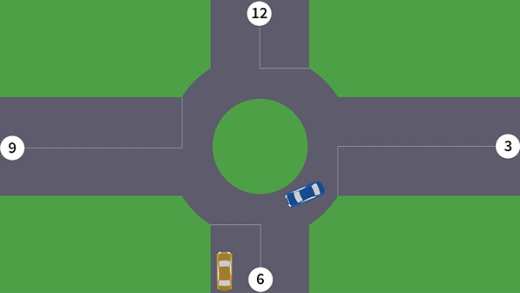

These include the date and time of the accident; the weather conditions at the time of the incident; the make, model and registration of all cars involved; details of any injuries; details of witnesses to the accident; notes on the damage caused to each car; and the position of the cars following the accident.

Some of these are easily recorded in photographs – so if you’ve got your camera phone handy, take photos from multiple angles that show the cars involved, and any damage.

Be mindful of what you say

Assuming responsibility for the accident could land you in hot water, and even a simple apology could become an issue in itself when it comes to making a claim. As strange as it may seem, avoid discussing the accident at the scene.

Exchange information

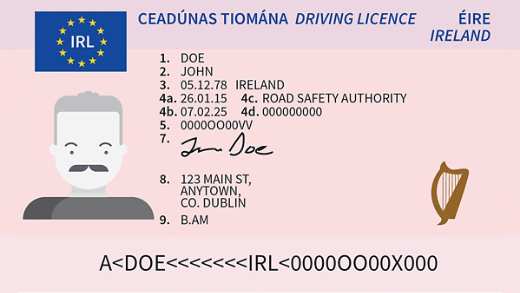

You should exchange your contact and insurance details with others involved in the collision and provide your address and personal details to the Gardaí.

If you’re alone

If there isn’t another party involved – for instance, if you’ve hit a parked car – then you have a responsibility to leave your contact details and insurers’ information for the owner to find; a note underneath the windscreen wiper is one common solution. Again, take the time to record the damage and other details you may need going forward and contact the Gardaí to report the incident.

Contact your insurer

It is crucial that you contact Aviva immediately by phoning 1800 147 147. Our staff are there to help you through this difficult time ensuring the incident is managed appropriately and provide you with advice. We will look for information such as your policy number, your name and address and your car registration number, the registrations of the other cars involved, the name and contact details of the other driver and passengers or witnesses, the other driver’s insurance details and any photos you took at the scene.

Even if you plan on paying for the damage yourself, it’s vital to inform your insurer immediately; this is because the other driver may bring a claim in the future.

Now that you know what to do when you have a car accident, have a look at our tips to survive an unexpected breakdown so you’re always prepared on the road.

With Aviva car insurance, you get a courtesy car for up to seven days while yours is being fixed by an Aviva Motor Services repairer if you make a claim under your policy after an accident. If you buy your car insurance online, you’ll get a 15% discount. Get your quote today.2

We encourage our customers, where possible, to make use of our online options to access any help you need. If you have a query you can reach us via our contact forms. MyAviva is an online self-service portal available to all our home and car insurance customers.